Minnesota Under Pressure: How a Wave of Expanding Fraud Cases Sparked a Political and Public Reckoning

For decades, Minnesota enjoyed a reputation as one of the most well-managed, civic-minded, and economically resilient states in the country—a place where strong institutions, generous social programs, and a culture of public trust formed the backbone of everyday life. But in recent years, a series of sweeping fraud investigations has cast a long, uncomfortable shadow over that reputation.

What began as a single high-profile case involving federal nutrition funds has widened into a series of investigations across multiple state-administered programs. And with each development, questions have mounted about oversight, accountability, and how such large-scale theft of taxpayer dollars could have taken place in a state long praised for its efficient governance.

At the center of the political fallout stands Governor Tim Walz, whose administration has been forced to confront what officials now estimate may total more than $1 billion in combined fraud across several public assistance systems—with some investigators warning the number could ultimately rise far higher.

The widening scandal has also pulled national figures into the dialogue, including Minnesota Congresswoman Ilhan Omar, after media reporting noted associations between her and individuals alleged to be connected to some of the schemes. While no wrongdoing has been attributed to Omar personally, the connections have intensified political scrutiny already surrounding the state’s handling of the crisis.

As the investigations deepen, Minnesota now finds itself grappling with a difficult truth: the combination of generous social programs, rapid administrative expansion, and gaps in oversight created opportunities for exploitation that criminals—domestic and international—were all too ready to seize.

This is the story of how a state known for its stability became the center of one of the largest clusters of fraud cases in modern American history—and why the fallout is far from over.

A Fraud Scandal That Shook the Nation: Feeding Our Future

The first earthquake hit in early 2022, when federal investigators revealed the Feeding Our Future case—one of the most extensive cases of pandemic-era fraud uncovered anywhere in the United States.

More than $250 million in federal food aid meant for children in need was allegedly siphoned off through a web of shell companies, falsified invoices, proposed meal sites that never existed, and kickback arrangements. Prosecutors described the scheme as “brazen,” “coordinated,” and “deliberate,” noting that thousands of fake meal claims were submitted to the state agency administering the program.

Court filings detailed purchases of luxury vehicles, overseas travel, high-end real estate, and other personal expenses funded by money intended to feed Minnesota children during the COVID-19 emergency.

The scale of the scheme was staggering, but so too was the method: the state agency responsible for oversight approved reimbursements despite red flags raised months earlier by internal staff and external auditors. Federal prosecutors later stated that their investigation was made significantly more difficult by administrative failures to halt suspicious claims earlier in the process.

Minnesota’s image as a model of good governance took its first major hit.

But as investigators dug deeper, another realization emerged: the Feeding Our Future case was not the end. It was the beginning.

A New Investigation Emerges: Housing Stabilization Services

In early 2024, a second wave of reporting raised alarms, this time centered on Minnesota’s Medicaid Housing Stabilization Services program. Designed to help vulnerable individuals secure and maintain stable housing, the program had grown rapidly since its creation—too rapidly, according to investigators.

A lengthy report by City Journal uncovered allegations that some organizations had exploited the program by billing for services never rendered, submitting claims for fictitious clients, and inflating the number of visits or hours of assistance provided.

The report cited concerns from state workers, policy analysts, and fraud specialists who noted patterns starkly similar to those revealed in the Feeding Our Future case:

Sudden spikes in billing from newly registered providers

Lack of documentation for claimed services

Minimal verification of program eligibility

Rapid expansion without matching oversight capacity

Some allegations went further. According to City Journal, federal investigators were examining claims that portions of misused funds from the Housing Stabilization program may have been diverted through informal networks or financial channels with international connections. Among the allegations under review were claims that some funds may have reached Al-Shabaab, an extremist organization operating in East Africa.

It is important to note that these claims remain under investigation and have not been confirmed publicly by federal authorities. Nonetheless, the possibility that Minnesota taxpayer funds could have been indirectly routed into overseas extremist networks alarmed lawmakers and intensified calls for immediate reform.

The Growing Total: How Big Is the Problem?

The Feeding Our Future case alone involved more than a quarter-billion dollars in fraud. But new estimates suggest that the total misuse of public funds in Minnesota may be significantly higher.

State investigators have privately estimated that fraud across several assistance programs—including childcare subsidies, pandemic economic relief, and Medicaid service billing—could total more than $1 billion.

Fox News correspondent Garrett Tenney reported that some federal whistleblowers believe the total could reach $8 billion once all investigations are complete—a number that, if accurate, would represent one of the most significant fraud losses by any single state in decades.

Small Business Administration officials examining possible improper Paycheck Protection Program activity in Minnesota stated that they uncovered more than $1 million in fraudulent loans within just two days of initial inquiry.

While the final amount remains uncertain, the trend is unmistakable: Minnesota experienced a concentration of fraud that investigators now describe as “systemic,” “multi-layered,” and “spanning numerous programs.”

How did this happen?

Oversight Under Fire: The Walz Administration Responds

As the allegations grew, Governor Tim Walz faced increasingly pointed questions—both from reporters and lawmakers—about oversight failures, accountability, and whether his administration had responded decisively enough when early warning signs emerged.

Walz has defended Minnesota’s broader social programs, emphasizing the state’s high rankings in economic growth, education outcomes, and quality of life. He has cited the state’s budget surplus as evidence of overall financial stability, while also acknowledging that fraud investigations reveal serious vulnerabilities.

“If individuals believe they can exploit Minnesota’s programs because of our generosity, they are sadly mistaken,” Walz said during a recent press briefing.

He vowed that those responsible would be prosecuted and emphasized that fraud does not reflect the purpose or value of the programs themselves.

But critics argue that the administration should have intervened more aggressively at earlier stages, particularly in the Feeding Our Future case, where state agencies continued to process claims even after internal staff flagged irregularities.

Opposition lawmakers have called for independent audits, legislative inquiries, and—some have suggested—a restructuring of several state agencies responsible for administering federal funds.

The debate now centers on a deeper issue: was the fraud a result of opportunists exploiting an unprecedented moment of federal spending, or did structural weaknesses in Minnesota’s administrative oversight enable years of unchecked misconduct?

The answer may be both.

Political Ripples: The Ilhan Omar Connection

Alongside the criticism directed at Governor Walz, a secondary political storyline emerged when RedState reported that Congresswoman Ilhan Omar had existing associations with at least two individuals connected to certain alleged fraud schemes.

Omar has not been accused of wrongdoing, nor have investigators suggested she played any role in the scandals. The connections cited involved individuals within community networks that intersected with political events, local organizations, or campaign activities.

In most circumstances, such incidental associations would not generate national attention. But given the scale of the investigations and Omar’s role as a high-profile federal lawmaker, the report added fuel to an already intense public discussion.

Political analysts note that Minnesota’s sizable East African immigrant community has historically been engaged in civic activity, entrepreneurship, and local politics. The involvement of individuals from any demographic community in alleged fraud cases should not be seen as indicative of the entire community, investigators frequently stress.

Still, the political optics have proven challenging, especially as state and federal officials work to rebuild public trust.

How Minnesota Became Vulnerable

Several underlying conditions enabled the proliferation of fraud:

1. Rapid Program Expansion

During the pandemic, federal emergency funds flowed into states faster than oversight mechanisms could adapt. Minnesota was no exception.

2. Administrative Bottlenecks

State agency staffing levels remained static even as caseloads expanded dramatically.

3. High Trust, Low Verification

Minnesota’s longstanding political culture of trust and generous program design did not anticipate widespread exploitation.

4. Reliance on Third-Party Providers

Many programs outsourced service delivery to private organizations, some of which were new, under-vetted, or inexperienced.

5. Insufficient Cross-agency Monitoring

Data systems across various state departments were not designed to detect fraud that crossed program boundaries.

Fraud specialists note that these vulnerabilities are not unique to Minnesota—but the convergence of all five factors at once created extraordinary opportunities for misuse.

The Public Reaction: Shock, Anger, and Concern

As details emerged, many Minnesota residents expressed disbelief that such widespread fraud could occur undetected. The sentiment was not merely political; it was cultural.

Minnesota built its identity on civic participation, good-faith public service, and trust in local institutions. For decades, it ranked among the top states for efficient governance and low corruption.

The recent investigations challenged deeply held assumptions about how vulnerable even the strongest systems can become under unprecedented pressure.

Community leaders have also raised concerns that the scandals could strain relationships between cultural groups, undermine trust in charitable organizations, or cast shadows on immigrant communities that have played an important role in Minnesota’s growth.

Officials have repeatedly emphasized that fraud is committed by individuals—not by communities, cultures, or demographic groups. But navigating public perception may prove as complex as navigating the investigations themselves.

A State at a Crossroads

Minnesota now faces a defining moment.

In the coming months and years, federal and state investigations will likely produce indictments, convictions, policy reforms, and perhaps structural changes within government agencies. But the deeper question is whether Minnesota can fully restore public confidence.

The fraud scandals have illuminated key challenges:

How does a state maintain generous public programs while protecting them from misuse?

How can oversight systems evolve as rapidly as the programs they support?

How do political leaders ensure accountability without eroding public trust?

And how does a state reconcile its proud history of good governance with the reality of unprecedented fraud?

Minnesota’s answers may shape national conversations about public-sector management for years to come.

Conclusion: A Cautionary Tale for Modern Governance

The story unfolding in Minnesota is not simply a tale of financial misconduct. It is a lesson in how modern systems—however well-designed—can be overwhelmed by speed, scale, and opportunism.

A state once held up as a national model now finds itself under an unwelcome spotlight, forced to confront the vulnerabilities exposed when billions of dollars move quickly and oversight struggles to keep pace.

Governor Walz faces the challenge of rebuilding trust. Lawmakers face the challenge of reform. Federal investigators face the challenge of untangling vast networks of alleged fraudulent activity.

And Minnesota residents face a new reality:

even the most stable foundations require vigilance.

This is not the end of the story.

It is the beginning of Minnesota’s reckoning—with lessons the entire country would do well to study.

News

FROZEN CLASH OF TITANS’: The Toxic Personal Feud Between Patton and Montgomery That Nearly Shattered the Allied War Effort

The Race for Messina: How the Fiercest Rivalry of World War II Re-shaped the Allied War Effort August 17, 1943.Two…

THE THRILL OF IT’: What Churchill Privately Declared When Patton Risked the Entire Allied Advance for One Daring Gambit

The Summer Eisenhower Saw the Future: How a Quiet Inspection in 1942 Rewired the Allied War Machine When Dwight D….

‘A BRIDGE TO ANNIHILATION’: The Untold, Secret Assessment Eisenhower Made of Britain’s War Machine in 1942

The Summer Eisenhower Saw the Future: How a Quiet Inspection in 1942 Rewired the Allied War Machine When Dwight D….

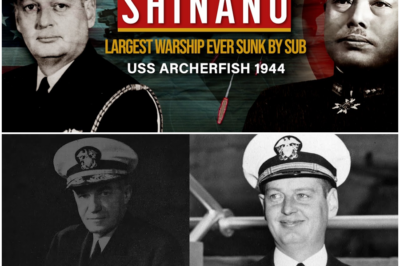

THE LONE WOLF STRIKE: How the U.S.S. Archerfish Sunk Japan’s Supercarrier Shinano in WWII’s Most Impossible Naval Duel

The Supercarrier That Never Fought: How the Shinano Became the Largest Warship Ever Sunk by a Submarine She was built…

THE BANKRUPT BLITZ: How Hitler Built the World’s Most Feared Army While Germany’s Treasury Was Secretly Empty

How a Bankrupt Nation Built a War Machine: The Economic Illusion Behind Hitler’s Rise and Collapse When Adolf Hitler became…

STALLED: The Fuel Crisis That Broke Patton’s Blitz—Until Black ‘Red Ball’ Drivers Forced the Entire Army Back to War

The Silent Army Behind Victory: How the Red Ball Express Saved the Allied Advance in 1944 In the final week…

End of content

No more pages to load