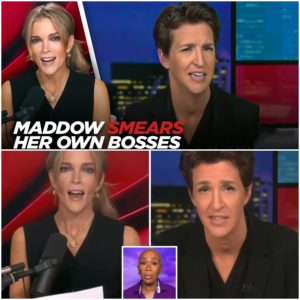

BREAKING: Rachel Maddow Warns of Major Crisis at the IRS—Is the Trump Administration ‘Wrecking’ the Agency?

In a shocking segment that has sent shockwaves through the media and political circles, Rachel Maddow sounded the alarm on recent developments at the IRS that could have significant and far-reaching consequences for the future of tax enforcement in the United States. During her Wednesday night broadcast, Maddow focused not on President Trump’s controversial tariff plans or his mass deportation strategies, but on what she described as a “mass exodus” of high-level executives from the Internal Revenue Service (IRS), signaling a much deeper problem within the federal government.

In a rare and alarming revelation, Maddow provided her viewers with a breakdown of the recent departures at the IRS, including the resignation of the agency’s Acting Head, Chief Financial Officer, Chief of Staff, and Chief Risk Officer. Maddow made it clear that this kind of sudden, widespread departure of top executives from a major government agency is a clear sign that something is seriously wrong.

“These aren’t the kinds of departures you see every day, especially in an administration that’s already known for its chaotic and dysfunctional behavior,” Maddow explained. “When you have key figures resigning at such a high level, it’s a pretty reliable sign that something is going terribly wrong behind the scenes.”

The Wrecking Ball Approach: Trump’s Strategy and the IRS Fallout

Maddow’s segment delved into the possibility that the Trump administration’s actions were directly responsible for this mass exodus, with one of the key flashpoints being the plan to give sensitive tax data to immigration authorities—a proposal that many saw as controversial and a serious breach of privacy and trust. According to reports, the Acting Head of the IRS, despite being in the position for only six weeks, resigned over this proposal.

Maddow didn’t hold back in calling out the administration’s approach, comparing it to the dismantling of other key government agencies like the Social Security Administration. “This is part of a pattern where the Trump administration is gutting vital agencies that millions of Americans rely on,” Maddow remarked. “The Social Security Administration is being dismantled in such a way that it threatens the livelihoods of disabled people and elderly Americans who rely on their monthly checks to cover basic living expenses like food, medicine, and rent.”

But the focus of Maddow’s concerns quickly shifted back to the IRS, where she warned that this mass resignation and the cuts to personnel were not just a bureaucratic issue but one that could undermine the entire functioning of the agency. With the resignation of the IRS’s top executives, Maddow raised the critical question: What happens if the IRS can’t operate effectively due to a lack of leadership and staff?

The Future of Tax Enforcement: A Disaster Waiting to Happen?

As Maddow pointed out, these departures are not just a personnel issue—they have real consequences for the future of tax enforcement in the United States. The IRS is responsible for collecting the tax revenue that funds the government and its programs, and any disruption to its operations could have dire effects on the nation’s finances.

Maddow’s analysis suggests that the Trump administration’s proposed cuts to the IRS, which include slashing a quarter of its workforce, could lead to severe financial repercussions. “The IRS is expected to bring in billions of dollars each year in tax revenue,” Maddow said. “By gutting the agency, we’re not only hurting the enforcement of tax laws, but we’re putting our entire financial system at risk.”

Furthermore, Maddow revealed that the Justice Department is also considering closing its tax enforcement division, which handles the prosecution of tax crimes. “If the Justice Department stops prosecuting tax crimes, what happens to our country?” Maddow asked, highlighting the dire consequences of the administration’s actions.

A Crisis of Accountability: What Happens If the IRS Breaks?

The question Maddow posed during her segment, “What happens to our country if the Trump administration breaks the IRS?” is one that many viewers have been grappling with since the news broke. Without an effective IRS to ensure that the wealthiest individuals and corporations pay their fair share of taxes, the financial burden could shift even more onto everyday Americans.

The potential dismantling of the IRS, combined with the broader pattern of defunding essential government programs, raises questions about the future of government services. Will the IRS be able to continue enforcing tax laws? Will the wealthy continue to evade taxes while the middle class bears the brunt of the nation’s financial obligations?

Maddow’s broadcast has ignited a nationwide conversation about the role of government agencies and the importance of accountability in the public sector. As the Trump administration continues to face scrutiny for its handling of key institutions, the impact on everyday Americans becomes clearer by the day.

Public Response: A Nation in Shock

The response from viewers and political analysts has been swift and overwhelmingly negative. Many are concerned about the consequences of this sudden shift in the IRS’s operations, with some calling it a deliberate attempt to weaken the government’s ability to manage its finances effectively. “The IRS is the backbone of our tax system,” one viewer commented on social media. “If this administration succeeds in weakening it, we’re all going to feel the effects.”

On the other hand, some conservative voices have defended the cuts, arguing that the IRS has become bloated and inefficient. However, the widespread resignation of senior officials has led to skepticism about the true motivations behind these actions. “If it’s about efficiency, why fire the people who’ve been managing the system for decades?” another social media user asked.

What Happens Next for the IRS and Tax Enforcement?

With the latest developments, the future of the IRS and its ability to function effectively remains uncertain. The resignation of top executives has raised concerns about the stability of the agency, and many are questioning whether the administration’s moves are an intentional effort to dismantle the IRS or simply an unfortunate byproduct of the Trump administration’s chaotic management style.

As the debate rages on, one thing is clear: the consequences of weakening the IRS could be catastrophic. From losing tax revenue to increased inequality, the fallout from this crisis could be felt for years to come.

What’s Your Take?

What do you think about the recent developments at the IRS? Are these changes in leadership part of a larger plan to dismantle the agency, or are they simply the result of poor management? Share your thoughts below and join the conversation about the future of the IRS and America’s tax system.

News

SHOCKING FAMILY REVEAL: He Stepped Into the Spotlight and the World Froze—A Single Post That Changed Everything! When a private truth was exposed to the world, hearts broke, tears flowed, and a family’s bond was tested in ways no one could have imagined.

SHOCKING REVEAL: Michael Consuelos Comes Out and Introduces His Boyfriend—A Heartfelt Moment That Has Left the Internet Buzzing! In a…

SHOCKING MOMENT: Elon Musk Joins Gutfeld! Panel—His First Words Leave the Studio in COMPLETE Silence! In an unexpected move that has taken late-night TV by storm, tech titan Elon Musk appeared as a guest on Gutfeld!

SHOCKING TV TAKEOVER: Elon Musk Stuns Gutfeld! Audience with Silent Power Move—Is This the Beginning of a New Era in…

SHOCKING REVEAL: Aishah Hasnie’s Hidden Truth Finally Exposed—Is This the Secret She’s Been Keeping from Fox News Fans?

Aishah Hasnie: Breaking Barriers in American Journalism with Grit, Faith, and Unmatched Dedication In an industry often dominated by familiar…

BREAKING: Elon Musk Reveals Shocking Truth About Son X Æ A-12—He Could Be the First Person to Set Foot on Mars! In a jaw-dropping revelation, Elon Musk has stunned the world by declaring that his 4-year-old son, X Æ A-12, may be the first person ever to reach Mars.

BREAKING: Elon Musk Calls His 4-Year-Old Son a Genius—Is He the One Who Will Lead Humanity to Mars? In a…

BREAKING NEWS: Karoline Leavitt Discovers Her Childhood Teacher Living in Squalor—The Shocking Act of Kindness That Will Leave You Speechless! When Karoline Leavitt, now a rising political star, stumbled upon her former teacher living in dire poverty, the discovery sent shockwaves through the nation.

Karoline Leavitt’s Heartbreaking Encounter with Her Former Teacher Sparks Groundbreaking Initiative to Support Retired Educators In the fast-paced world of…

SHOCKING SECRET: Taylor Swift and Travis Kelce Throw a Surprise 100th Birthday Party for Taylor’s First Music Teacher—Her Gift Will Leave You in Tears! In a quiet Nashville nursing home, Evelyn Harper, Taylor Swift’s first guitar teacher

EXCLUSIVE: Taylor Swift and Travis Kelce’s Secret Surprise for Taylor’s First Teacher—A Heart-Wrenching Gift That Left Everyone in Tears In…

End of content

No more pages to load