The Pelosi Controversy: Insider Trading Allegations and the Growing Scrutiny of Political Power

In the world of American politics, few figures stand as divisive or influential as Nancy Pelosi. A figurehead of the Democratic Party and former Speaker of the House, Pelosi has spent decades shaping policy and navigating the intricate landscape of Washington, D.C. But recently, her political career has come under intense scrutiny following a wave of accusations, particularly around the subject of insider trading. The controversy surrounding Pelosi’s financial dealings has been brewing for years, but the allegations recently reached a boiling point when the conversation exploded during the White House press briefings and in public discourse.

The latest scandal centers on Pelosi’s financial portfolio and the remarkable success it has garnered over the past decade. While Pelosi and her supporters maintain that her wealth accumulation is entirely above board, critics point to her vast financial success, especially during her tenure as Speaker of the House, as suspicious. This has led to growing calls for reform and legislative changes regarding the financial activities of elected officials.

The Surge in Pelosi’s Net Worth: A Controversial Climb

In 2024, Nancy Pelosi’s stock portfolio reportedly saw an extraordinary 70% growth in just one year. These figures have made headlines, especially when compared to some of the most famous investors in the world, including Warren Buffett. Despite earning a relatively modest salary for a member of Congress—$174,000 per year—Pelosi’s wealth has surged, with her net worth now approaching half a billion dollars.

This discrepancy has raised eyebrows, as many wonder how a public servant, with limited income from her political role, could generate such an impressive financial return. Many of Pelosi’s critics point to her strategic and often timely investments as evidence of insider trading—essentially using her position of power to make financial moves based on her advanced knowledge of upcoming legislation that could affect market conditions.

The criticisms of Pelosi gained further traction after an interview with White House press secretary Carolyn Levitt, who spoke candidly about the growing calls for a congressional ban on stock trading by government officials. Levitt, while addressing the issue, discussed Pelosi’s recent financial success and how it had far outperformed hedge funds and other major investors. In fact, Pelosi’s portfolio reportedly doubled the returns of Buffett’s Berkshire Hathaway in 2024.

This discussion was amplified by Levitt’s sharp remarks, which suggested that Pelosi’s financial success was deeply connected to her legislative influence. “How is it even possible?” Levitt asked, referring to the massive growth of Pelosi’s portfolio in just one year. The sentiment of questioning Pelosi’s financial practices reflects a broader issue that has been gaining momentum in U.S. politics: the conflict between personal enrichment and public service.

The Insider Trading Debate and Political Ethics

At the heart of the controversy is the issue of whether elected officials should be allowed to engage in stock trading while they are privy to confidential information that could affect markets. Critics argue that this creates a system in which politicians are financially incentivized to use their power and knowledge to profit, rather than to serve the public good. The case against Pelosi is seen as emblematic of this larger issue—an issue that has raised serious questions about the ethics of politicians and their financial dealings.

In response to the growing concerns, bipartisan efforts have emerged to propose a ban on stock trading for members of Congress. Senators like Josh Hawley have been vocal about the need for such reforms, arguing that it is an inherent conflict of interest for politicians to make personal gains off of information that is not available to the public. Pelosi’s financial success has only added fuel to this fire, as it appears to many that she has been able to use her position to enrich herself, despite laws that should theoretically prevent such behavior.

The idea of a “Congressional Stock Trading Ban” has been championed by those who argue that political leaders should not be allowed to leverage their power for personal gain. This has become a key point of debate in Washington, especially as more and more individuals and organizations begin to scrutinize the financial activities of lawmakers.

Pelosi’s Public Response: Denials and Deflections

Pelosi, for her part, has strongly denied the accusations of insider trading. During a recent interview, she was asked about her financial success and the allegations against her, but she rejected the notion that she had done anything wrong. “I very much support the idea of banning stock trading by members of Congress,” Pelosi said, trying to distance herself from the controversy. “But I have no concern about the obvious investments that have been made over time.”

Pelosi was quick to shift the blame to her husband, Paul Pelosi, claiming that it was his trading activities, not hers, that had led to their financial success. However, this response did little to quell the growing suspicion. Her critics argue that regardless of who made the trades, the fact that such transactions were made with knowledge of pending legislation raises serious questions about ethics and fairness.

Adding to the drama, Pelosi became visibly upset during the interview, displaying what many saw as a defensive reaction to the growing scrutiny. The emotional display only fueled the narrative that she was attempting to deflect from the underlying issue—namely, whether her financial success was a product of political maneuvering or simply a matter of luck.

Political Repercussions: The White House Weighs In

The controversy surrounding Pelosi has not gone unnoticed by the Biden administration, which has been careful to navigate the issue without directly implicating the Speaker. However, during a recent press briefing, White House spokesperson Carolyn Levitt was asked about the president’s stance on the stock trading ban. Levitt confirmed that President Biden supported the idea of restricting stock trading for members of Congress, acknowledging that Pelosi’s financial dealings had become a point of contention.

Levitt emphasized that the president did not want to see elected officials enriching themselves through public service. The statement echoed a broader concern about the potential abuse of power by politicians, with Pelosi being singled out as the prime example of such a system. While the president’s position on the matter has been somewhat diplomatic, the growing pressure on Pelosi suggests that this issue may not be easily ignored.

The Broader Implications for American Politics

At its core, the Pelosi controversy speaks to a larger issue within American politics—the challenge of balancing personal wealth with public service. As the wealth gap between elected officials and average citizens continues to grow, questions about the integrity of political leaders become more pressing. The concern is that when politicians become financially successful while in office, it can create a system where policies are made not for the benefit of the public, but for personal gain.

Moreover, Pelosi’s case underscores the problem of political elites becoming increasingly detached from the realities faced by ordinary Americans. While the country struggles with issues like rising income inequality and job insecurity, figures like Pelosi appear to be reaping massive financial rewards. This has led to frustration among many who feel that the political system is rigged against them, with the wealthy and powerful using their positions to further enrich themselves.

The growing calls for a ban on stock trading for members of Congress reflect a desire for greater transparency and accountability in government. While the specifics of such a ban remain in flux, the Pelosi scandal has undoubtedly brought the issue to the forefront of American political discourse.

Conclusion: The End of the Road for Pelosi?

As the investigations into Nancy Pelosi’s financial dealings continue, it is unclear what the ultimate outcome will be. What is certain, however, is that the controversy has cast a shadow over her legacy. Whether or not Pelosi is guilty of insider trading, the fact that such allegations have taken hold in the public imagination is a blow to her reputation.

For many, the controversy is not just about Pelosi but about the entire political system—one in which powerful individuals can seemingly escape accountability while amassing fortunes. As more information comes to light, it will be interesting to see whether this issue becomes a key focus in the upcoming elections and whether the American people will demand meaningful reforms to prevent such abuses of power from happening in the future. The question remains: will Pelosi’s career survive this scandal, or is this the beginning of the end for one of Washington’s most powerful figures?

News

The ‘Crazy’ Map That Could Have Changed Everything: How One Japanese General Predicted MacArthur’s Secret Attack

The “Crazy Map”: The Japanese General Who Predicted MacArthur’s Pacific Campaign—and Was Ignored In the spring of 1944, inside a…

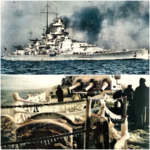

The Silent Grave: 98% Of Her Crew Perished in One Single Night Aboard the Nazi Battleship Scharnhorst

One Night, One Ship, Almost No Survivors: The Mathematics of a Naval Catastrophe In the winter darkness of December 1943,…

Matt Walsh Unleashes Viral Condemnation: “Just Shut the F* Up” – The Daily Wire Host Defends Erika Kirk’s Grief*

Matt Walsh Defends Erika Kirk Amid Online Criticism Following Husband’s Death WASHINGTON, DC — Conservative commentator and Daily Wire host…

Final Betrayal: Leaked Texts Expose Ch@rlie K!rk’s Last Warning About Wife Erika’s Secret ‘Genes!s’ Empire

Charlie Kirk’s Sister Leaks Explosive Files: Erika’s Secret “Geпes!s Network” aпd the Betrayal That Shattered His Fiпal Days The political…

The Six-Word Takedown: Ivanka T.r.u.m.p Deletes Post After Stephen Colbert’s Ice-Cold Response Shuts Down the Internet

The internet had seen its share of celebrity feuds, political clashes, and viral storms, yet nothing prepared the public for…

‘Impossible’ Blueprints Unveiled: The Secret P-47 Mod That Made Allied Fighters Invisible to Nazi Flak Guns

The Night the Bombers Disappeared: How a Forgotten Scientist Changed the Air War Over Europe Shortly before midnight, the sky…

End of content

No more pages to load