Elon Musk’s Brother Suddenly Dumps Tesla Stock Worth $28 Million: What’s Happening to the Trillionaire Empire?

In a shocking move that has sent ripples through the stock market, Elon Musk’s brother, Kimbal Musk, has sold off $28 million worth of Tesla stock, raising questions about the future of the Musk family empire and the state of Tesla itself. This unexpected decision has left investors, industry experts, and fans alike wondering: Is something going on behind the scenes at Tesla, or is this just a strategic financial move?

Kimbal Musk, a board member at Tesla and a longtime supporter of his brother’s ventures, has always been closely tied to the success of Tesla and other Musk family businesses. His sudden stock sale, which was disclosed in recent SEC filings, has fueled speculation about the financial health of Tesla and the wider Musk empire — which includes companies like SpaceX, Neuralink, and The Boring Company.

The $28 Million Tesla Stock Sale

According to the filings, Kimbal Musk liquidated a significant portion of his Tesla holdings, selling shares worth approximately $28 million. This sale comes as a surprise, especially considering the ongoing boom in Tesla’s stock price and the company’s continued dominance in the electric vehicle market.

While Kimbal Musk has always maintained a relatively low profile compared to his brother Elon, this stock sale is a stark reminder of how closely the Musk family is tied to Tesla’s success — and how much influence their financial decisions can have on the broader market. The news of this sale has already made waves, with analysts closely watching Tesla’s stock in response.

“Kimbal Musk’s decision to sell this amount of stock is undoubtedly a significant event,” said an anonymous stock analyst. “It raises questions about whether this is a personal financial move or whether it’s signaling something larger about the future of Tesla and the Musk empire.”

The Impact on Tesla and Musk’s Empire

The question on everyone’s mind is: What does this stock sale mean for the future of Tesla and Elon Musk’s trillion-dollar empire? Tesla has long been one of the most valuable companies in the world, with its market cap recently crossing the $1 trillion mark. But as the stock market continues to fluctuate, many are wondering whether this move by Kimbal Musk is a sign of potential turbulence ahead for the electric vehicle giant.

Tesla’s stock has been on a wild ride in recent months, with its valuation reaching unprecedented heights, only to be followed by sudden dips. With Elon Musk’s focus on other ventures like SpaceX and his Twitter acquisition, questions about his leadership of Tesla and the direction of the company have begun to surface. Kimbal Musk’s decision to dump millions in stock could be a reflection of the growing uncertainty surrounding the future of the company and its market performance.

“There’s a lot of speculation that Kimbal Musk’s decision could be linked to his concerns about the stability of Tesla’s stock or his belief that the company has reached its peak,” said one financial expert.

Is This a Sign of Trouble?

While some have speculated that Kimbal Musk’s stock sale is an indication of trouble at Tesla, others believe this is simply a personal decision unrelated to the company’s future. Kimbal Musk is an entrepreneur in his own right, with investments in sustainable food initiatives and a focus on philanthropy, and it’s possible that he is simply reallocating his assets for personal reasons.

However, given the significance of the sale and the timing — with Tesla’s stock riding high and Elon Musk making waves with his ventures — many are left wondering if there are broader financial or strategic factors at play.

Kimbal’s Future and the Musk Family’s Legacy

As the Musk family continues to grow its empire, it’s clear that Kimbal Musk’s financial decisions will be watched closely by investors and market analysts. While Elon Musk remains the public face of the family’s ventures, Kimbal has played a critical role in supporting Tesla and other Musk-led projects.

Kimbal Musk’s $28 million stock sale raises important questions about the stability of the Musk empire and whether the family’s ventures — from Tesla to SpaceX — are facing internal or external challenges. As for the future of Tesla, this event serves as a reminder that even the most successful companies are vulnerable to shifts in the market, and key players within the company may be making moves that reflect their concerns for the future.

For now, investors and fans will be keeping a close eye on Tesla’s stock and the Musk family’s financial decisions. Will this stock sale signal a shift in the future of Tesla, or is it simply a personal decision for Kimbal Musk? Only time will tell.

News

“Pam Bondi Wins Major Legal Victory Over Lia Thomas—Olympic Ban and Historic Penalty for Cheating in Women’s Sports!” In a dramatic turn of events, Pam Bondi has emerged victorious in her legal battle against Lia Thomas, leading to a historic Olympic ban for the trans swimmer. This groundbreaking decision is a major win for women’s sports, with experts calling it the heaviest penalty in sports history for cheating. What does this legal victory mean for the future of fairness in competitive sports, and how will it impact the Olympic landscape? Find out everything you need to know about this explosive moment that’s making waves around the globe….

“Pam Bondi Wins Major Legal Victory Over Lia Thomas—Olympic Ban and Historic Penalty for Cheating in Women’s Sports!”In a dramatic…

“The View Drops Bombshell Announcement—Massive Changes for Next Season That Will Shock Fans!” In an unexpected twist, The View has confirmed massive changes for next season, leaving fans buzzing with anticipation. From a new panel of hosts to a complete reimagining of the show’s format, these changes promise to be a game-changer. What’s driving this dramatic shift, and how will it affect the future of daytime TV’s most famous talk show? Find out the exclusive details behind the shocking update that has everyone talking….

“The View Drops Bombshell Announcement—Massive Changes for Next Season That Will Shock Fans!”In an unexpected twist, The View has confirmed…

“Joy Reid Finally Exposes the Real Reason She Was Fired from MSNBC—The Shocking Truth No One Saw Coming!” After being fired from MSNBC at the peak of her career, Joy Reid has finally spoken out about the real reasons behind her sudden dismissal. The shocking truth has been exposed, and it’s a revelation that no one saw coming. What was the real cause of her brutal firing, and why did it remain hidden for so long? Find out the full, jaw-dropping details behind Reid’s departure and the truth that has now come to light….

“Joy Reid Finally Exposes the Real Reason She Was Fired from MSNBC—The Shocking Truth No One Saw Coming!”After being fired…

“Tyrus Shuts Down Jasmine Crockett LIVE on Air—‘The Truth Hammer’ Rips Through the Debate, Leaving Crockett Speechless!” What started as a typical political debate turned into an unforgettable on-air explosion when Tyrus unleashed a series of facts that left Jasmine Crockett floundering. With Crockett unable to counter his points, producers behind the scenes scrambled to regain control, but the damage was already done. The viral moment has left fans in awe of Tyrus’s calm, fearless response, earning him the nickname “The Truth Hammer.” Critics are divided, but one thing is clear: Crockett was caught off guard. Read on for the full, jaw-dropping details of this chaotic live TV confrontation….

“Tyrus Shuts Down Jasmine Crockett LIVE on Air—‘The Truth Hammer’ Rips Through the Debate, Leaving Crockett Speechless!”What started as a…

“Julie Banderas Makes Stunning Comeback After Painful Divorce—From Rock Bottom to Redefining Success in the Media World!” In an inspiring and emotional journey, Julie Banderas has transformed the pain of her divorce into a powerful comeback. From candid confessions to bold career moves, the Fox News anchor has surprised fans with her ability to reinvent herself and rise to new heights. After the scandal and heartbreak, Banderas is taking control of her future and redefining what success looks like. Learn how this media powerhouse overcame adversity and is now making waves in the industry like never before…

“Julie Banderas Makes Stunning Comeback After Painful Divorce—From Rock Bottom to Redefining Success in the Media World!”In an inspiring and…

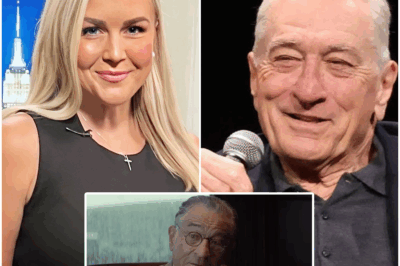

“Robert De Niro Slams Karoline Leavitt as Unfit to Be a Role Model for Women—The Shocking Truth Behind His Statement Revealed!” Robert De Niro has stunned fans and media insiders by claiming that Karoline Leavitt is unqualified to be a role model for women, a statement that has ignited a fierce debate. The actor’s harsh words have raised eyebrows, with many wondering what led to such a bold declaration. What’s the surprising truth behind De Niro’s comment, and why has this moment set the internet on fire? The full story behind this shocking revelation is here—find out what has everyone talking…

“Robert De Niro Slams Karoline Leavitt as Unfit to Be a Role Model for Women—The Shocking Truth Behind His Statement…

End of content

No more pages to load