“‘Step aside, Andy Byron!’ – Megan Kerrigan FURIOUSLY FIRES BACK at Pete DeJoy’s $325 million takeover bid for the company following a scandal that sent shares plummeting. Andy Byron erupts with the powerful statement: ‘They may mock my pain, but they will never silence my voice.’”

In the world of high-stakes corporate takeovers, bold plays and sharp responses are nothing new. But what happened this week between business leaders Megan Kerrigan, Pete DeJoy, and Andy Byron has left analysts, investors, and boardrooms everywhere reeling. A $325 million bid. A defiant rejection. And a war of words that has turned a business negotiation into something much more personal — and far more dramatic.

The tension began brewing shortly after a recent scandal rocked the firm at the center of the storm — a company once considered one of the most promising growth stories in its sector. As public trust wavered and share prices began to slide, it seemed inevitable that opportunists would begin circling.

Enter Pete DeJoy, a seasoned investor and strategic magnate known for identifying distressed assets and converting them into long-term winners. With the stock price tumbling and the company’s leadership under pressure, DeJoy reportedly extended a bold $325 million offer for majority control — a move he described as “timely and beneficial to all stakeholders.”

But not everyone saw it that way.

The Rejection Heard Around the Boardroom

Megan Kerrigan, interim CEO and one of the company’s most resilient figures during the recent crisis, responded swiftly and unequivocally. In a now widely circulated internal memo — later confirmed by several executives — Kerrigan reportedly confronted DeJoy’s proposal head-on with a blunt directive:

“Step aside, Andy Byron!”

The comment, though directed at Byron, DeJoy’s longtime associate and board ally, sent a clear message: this was not the time for a hostile maneuver. Kerrigan went further in her formal response to the offer, calling it “a transparent attempt to capitalize on short-term chaos rather than contribute to long-term value.”

Sources close to Kerrigan say her rejection wasn’t just about dollars — it was about principle.

“She believes in rebuilding from within,” said a senior executive familiar with her strategy. “She’s not going to hand over the reins just because the stock dipped. That would be conceding defeat.”

The Scandal That Set It All in Motion

The origins of the crisis trace back to a series of operational missteps and an internal compliance breach that shook investor confidence. Though not criminal in nature, the incident led to a public loss of faith and a swift devaluation of the company’s market cap by nearly 40%.

While Kerrigan, who took over after the previous CEO’s abrupt resignation, has spearheaded transparency efforts and introduced reform measures, the damage to the stock was already done. That’s when DeJoy saw his opening.

Industry insiders say the bid was strategically timed — not just to buy low, but to exploit a moment of internal disorganization and external pressure. It was a classic play from DeJoy’s well-worn handbook.

But he may have underestimated the new leadership’s resolve.

Andy Byron Breaks His Silence

In the wake of Kerrigan’s fiery pushback, Andy Byron — a board member and former confidant of the previous CEO — made his own headlines with an emotional response that caught many off guard.

“They may mock my pain,” Byron said in a statement during a closed-door investor Q&A session, “but they will never silence my voice.”

Observers say Byron was referring to recent criticisms and internal resistance regarding his support for DeJoy’s acquisition attempt. While he has not publicly confirmed his alliance with DeJoy, multiple sources confirm that he acted as an intermediary between DeJoy and key shareholders in the lead-up to the bid.

Some say Byron feels personally betrayed — not just professionally isolated.

“There’s a deeper story here,” one analyst commented. “This isn’t just business — it’s about legacy, about control, and about the right to shape the future of a company you helped build.”

What’s Really at Stake

At its core, the clash among Kerrigan, DeJoy, and Byron is about more than just a company — it’s about vision. Kerrigan sees a path forward rooted in stability, transparency, and employee trust. DeJoy, by contrast, envisions a leaner, more profitable version of the firm under new management and possibly new branding.

Byron, caught in the middle, appears torn between loyalty to the past and concern for the company’s direction. His emotional statement resonated with many long-time employees who remember his contributions, but it also raised concerns about whether emotion is clouding judgment at a critical juncture.

Meanwhile, shareholder groups remain divided. Some see DeJoy’s offer as a lifeline. Others view it as a hostile move designed to extract value without preserving the company’s culture or commitments.

The Industry Reacts

As news of the standoff spreads, industry leaders and corporate governance experts have weighed in.

“Hostile bids during vulnerable moments are nothing new,” said Marlene Chu, a professor of business ethics at Stanford. “But what’s rare is seeing such a dramatic public clash between internal leadership and external power brokers — all while the future of the company hangs in the balance.”

Others note that Kerrigan’s decisive stance may inspire other leaders to resist similar pressure.

“She’s not playing the traditional game,” said a former Fortune 500 CEO. “She’s rewriting the script — and win or lose, that’s going to leave a mark.”

What Happens Next?

As of this writing, DeJoy has not withdrawn his offer. In fact, sources close to the deal suggest he may raise it, confident that mounting pressure from anxious investors will eventually tip the scales in his favor. Kerrigan, for her part, has convened a special strategy task force and is reportedly working on a recovery plan designed to restore investor confidence — and fend off further acquisition attempts.

Whether her plan will succeed is unclear. What is certain, however, is that this battle is far from over.

The next shareholder meeting, scheduled for next month, could become the defining moment of this corporate saga — a showdown not just of numbers, but of narratives. Will it be the story of a resilient CEO saving her company from opportunistic takeover? Or will it mark the turning point where strategic pragmatism overrides principle?

News

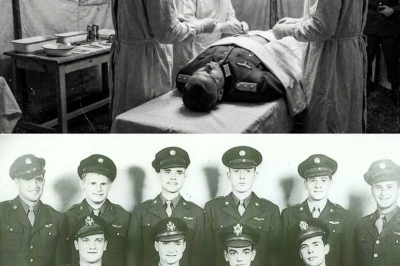

The Night Watchman’s Most Puzzling Case

A determined military policeman spends weeks hunting the elusive bread thief plaguing the camp—only to discover a shocking, hilarious, and…

The Five Who Chose Humanity

Five British soldiers on a routine patrol stumble upon 177 stranded female German prisoners, triggering a daring rescue mission that…

The Hour That Shook Two Nations

After watching a mysterious 60-minute demonstration that left him speechless, Churchill traveled to America—where a single unexpected statement he delivered…

The General Who Woke in the Wrong World

Rescued by American doctors after a near-fatal collapse, a German general awakens in an unexpected place—only to witness secrets, alliances,…

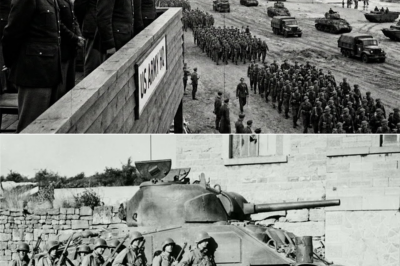

American generals arrived in Britain expecting orderly war planning

American generals arrived in Britain expecting orderly war planning—but instead uncovered a web of astonishing D-Day preparations so elaborate, bold,…

Rachel Maddow Didn’t Say It. Stephen Miller Never Sat in That Chair. But Millions Still Clicked the “TOTAL DESTRUCTION” Headline. The Fake Takedown Video That Fooled Viewers, Enraged Comment

Rachel Maddow Didn’t Say It. Stephen Miller Never Sat in That Chair. But Millions Still Clicked the “TOTAL DESTRUCTION” Headline….

End of content

No more pages to load