George Strait Walked Away From New York — and the City’s Concert Economy Instantly Hit Turbulence. Promoters Are Panicking, Economists Are Warning, and Fans Are Wondering How One Decision Shook an Entire Live-Music Capital. Inside the Sudden Revenue Drop That No One Saw Coming, and Why Some Experts Say the Real Damage Hasn’t Even Shown Up in the Numbers Yet. If New York Can Lose This Much From One Cancellation, People Are Asking: What Happens If Other Superstars Follow Him Out the Door?

When word first broke that George Strait was canceling every New York City stop on his tour, most people assumed it was just another scheduling shakeup. Big stars move dates all the time. But within days of the announcement, venue managers and ticket brokers started to notice something that had nothing to do with one singer’s calendar: the cash registers across the city’s live-music scene were suddenly a lot quieter.

According to early tallies from venue operators and ticketing insiders, weekly concert revenue in New York City slid sharply in the immediate aftermath of Strait’s withdrawal. It wasn’t just his own shows disappearing from the books. Refund requests spiked for unrelated events, pre-sales for other major tours slowed, and some promoters quietly pulled the plug on smaller concerts that suddenly looked too risky to go forward.

“It was like somebody flipped a switch on buyer confidence,” said one Midtown promoter who works with both arena acts and theater-sized tours. “The moment fans saw that a guaranteed, locked-in, can’t-miss run like George Strait’s could vanish, they got cautious. They started thinking twice about every ticket in their cart.”

Economists watching the city’s post-pandemic recovery say that reaction is exactly what they were afraid of.

A Cancellation That Hit Different

Cancellations are nothing new in live entertainment. Weather, illness, logistics — there’s always something that can force a show to be postponed or scrapped. But George Strait’s decision landed differently for several reasons.

First, the timing. His New York dates had been heavily promoted for months, with ads plastered across subway stations, digital billboards, and streaming radio. Many of the shows were either sold out or close to it, drawing not just local fans but visitors from across the Northeast who had booked hotel rooms and travel around the concerts.

Second, the symbolism. Strait isn’t just another name on a tour poster. He’s a country icon with a reputation for reliability, the kind of artist fans assume will show up unless something truly unavoidable happens. When a figure with that kind of steady image walks away from one of the world’s biggest markets all at once, it sends a message — even if no one intended it that way.

“It felt like the ground moved under us,” said Carla Benson, who manages a large arena in Brooklyn. “We’ve had artists reschedule before, we’ve had acts move to different venues. But pulling an entire run out of New York in one sweep created this sense that nothing is guaranteed, not even the big anchor shows we build our calendars around.”

Officially, the decision was chalked up to tour-related concerns and scheduling issues. Unofficially, the shock rippled far beyond the dates on Strait’s contract.

The Numbers Start to Tell a Story

The early revenue figures aren’t final, but the direction is clear. Several large venues report that, in the week following Strait’s cancellation, overall concert revenue in the city fell noticeably compared with the same period last year and with internal projections for this season.

“It’s not just the missing George Strait shows — we can account for that separately,” explained an analyst at a New York–based entertainment consultancy who asked not to be named because they advise multiple venues. “What has people rattled is the spillover. We’re seeing weaker day-of sales, softer pre-sales for unrelated acts, and a spike in last-minute refund requests. That points to a confidence problem, not just a scheduling adjustment.”

One midtown theater, which had been expecting a strong week thanks to a run of mid-level touring acts, reported a double-digit percentage drop in walk-up sales compared with projections made before the Strait news. A smaller club on the Lower East Side saw group bookings for a series of weekend shows get canceled within 48 hours of the announcement.

“People were writing in saying, ‘We just want to wait and see what happens with all these tours now,’” said the club’s owner. “They weren’t even coming to see country music. They just got spooked.”

That sense of unease is exactly what economists describe as a “confidence shock” — a moment when consumer assumptions suddenly change, leading to behavior that can snowball into bigger problems.

Why One Artist Matters in a City of Millions

At first glance, it seems odd that a single performer’s absence could shake the finances of a city that hosts thousands of concerts every year. But experts say that’s not how modern live entertainment works.

“Big-name tours act as anchors in a market,” explained Dr. Dana Liu, a cultural economist who studies entertainment spending in large cities. “They draw attention, they create buzz, and they signal stability. When a star announces a major run in a city like New York, other acts — and other businesses — plan around that. They expect increased tourism, higher traffic, and a general wave of spending.”

Pull that anchor out suddenly, and you don’t just lose ticket revenue for those specific shows. You also risk weakening the entire ecosystem built around them.

Think about the web of businesses tied to a run of arena concerts: hotels counting on visiting fans, restaurants planning extra staff, rideshare drivers expecting surges, even corner bodegas that stock up for late-night crowds. When those assumptions get rattled, the caution spreads quickly.

“That’s the part that worries us,” Liu said. “If fans start thinking, ‘Why book flights now when my concert might vanish a few weeks before?’ they may delay trips or skip them entirely. Multiply that by multiple artists, and you’re looking at a real drag on a sector that’s been crucial to New York’s recovery.”

A “Cultural Shock” With Real-World Consequences

Several industry insiders have taken to calling the fallout a “cultural shock” — not because New Yorkers suddenly stopped loving live music, but because their relationship with it shifted overnight.

Before the cancellation, the narrative around the city’s concert scene was largely upbeat. Big tours were back, smaller venues were filling their calendars, and fans seemed eager to make up for lost time after years of disruptions. Ticket prices were high, but so was enthusiasm.

Now, there’s a new layer in the conversation: “What if it doesn’t happen?”

“On our customer service lines, we went from questions about parking and seating to questions about cancellation policies and travel insurance,” said a representative for a major ticketing platform. “People want to know exactly what happens if a show falls through. That tells you where their heads are at.”

Even artists feel the shift. One singer-songwriter scheduled to play a mid-size New York venue next month described an unusual wave of messages from fans.

“I started getting notes along the lines of, ‘Are you definitely coming? Can you promise you won’t cancel?’” she said. “I’ve never had people ask me that so directly. It shows how much this one story got into their minds.”

Economists Warn: This Is About More Than Concerts

The early revenue numbers are worrying enough for venue owners. But economists are concerned about something broader: the way a hit to concert spending can ripple through the wider city economy.

Live entertainment is a major driver of what’s often called the “experience sector” — everything from dining and nightlife to transportation and retail. A strong concert calendar doesn’t just fill arenas; it fills hotel rooms, restaurant tables, and late-night subway cars.

“New York has been leaning heavily on tourism and entertainment to offset softness in other parts of the local economy,” said Marcus Hill, a regional economist who tracks major metro areas. “Anything that shakes confidence in that engine is a risk, especially if it encourages people to delay or cancel trips.”

Hill points out that even a temporary drop in concert revenue can have outsized effects if it changes planning decisions months out. If a family in another state decides not to book a weekend in the city because they’re suddenly nervous about ticket reliability, that’s hotel money, dining money, and shopping money that never arrives.

“What keeps me up at night isn’t the week-to-week revenue dip,” Hill said. “It’s the possibility that we’re looking at the start of a longer-term hesitation, where people reorder their spending away from big city experiences because they no longer feel locked-in and reliable.”

Fans and Small Businesses Caught in the Middle

While analysts debate percentages and trends, the practical fallout is landing on two groups that have little control over any of it: fans and small businesses.

Take the story of Maria and Jason, a couple from New Jersey who had planned to make one of Strait’s New York shows the centerpiece of a rare kid-free weekend. They’d booked a hotel, lined up a dinner reservation, and even scheduled time to visit a museum.

“When the shows were canceled, it wasn’t just the ticket money,” Maria said. “We suddenly had this whole trip that didn’t make sense anymore. We got most of our costs refunded, but it felt like the air went out of the balloon. Now we’re both saying, ‘Let’s not plan anything like that again unless we’re really sure.’”

Across the river in Queens, a bar owner who routinely hosts post-concert crowds from nearby arenas says the difference was visible.

“Those big shows are like mini-holidays for us,” he explained. “You staff up, stock up, and you know you’re going to have a huge night. When this run disappeared, we didn’t just lose those nights — we saw the crowds for other shows get thinner, too. People stayed home.”

For smaller venues, the shift in mood can be even more delicate. Many depend on a mix of local acts and mid-tier touring artists, and they don’t have deep reserves to absorb multiple soft weekends.

“If enough people decide to skip a show here, a show there, we feel it right away,” said one downtown club operator. “And when the headlines are all about big cancellations and uncertainty, that’s exactly the kind of thinking that creeps in.”

Could Other Stars Follow?

The question now hanging over the industry is simple and unsettling: will other major artists look at the current climate and make similar decisions about New York?

So far, no wave of additional cancellations has struck the city. Many tours remain on track, and some promoters are doubling down on marketing efforts to keep momentum going. But the fact that the question is being asked at all is a sign of how fragile confidence can be.

“If you’re a top-tier act planning a tour, you’re watching this very closely,” said the Midtown promoter. “You’re asking your team, ‘Do we change routing? Do we build in more flexibility? Do we avoid markets where fans suddenly seem jumpy?’ That’s not the conversation we want happening about New York.”

City officials and industry groups are already huddling over strategies to shore up the market. Ideas on the table include expanded event insurance options, clearer refund policies, cooperative marketing campaigns that emphasize reliability, and new incentives to keep big acts locked into their New York dates.

“We can’t control every tour decision,” said one official familiar with those discussions. “But we can control how confident fans feel buying tickets here. That’s going to be the key in the months ahead.”

What Comes Next for New York’s Concert Scene?

Nobody expects New York City — a place practically built on live performance — to lose its status as a global entertainment hub overnight. The stages are still here. The fans are still here. The talent pipeline is still strong.

But this episode has served as an unexpected stress test, and it exposed just how quickly confidence can wobble when a single high-profile cancellation hits at the wrong time.

In the short term, venues are likely to lean into transparency: clearly posted policies, rapid communication if anything changes, and flexible options that make ticket-buyers feel protected. In the longer term, economists say the city may need to think about its concert economy the way it thinks about its financial markets — as something that depends as much on psychology as on numbers.

“New York has weathered bigger shocks than one canceled tour,” Dr. Liu noted. “But what makes this moment interesting is what it reveals. If one artist’s decision can jolt revenue and rattle consumer confidence this fast, it tells you how tightly wound the system is.”

For now, the spotlight remains on the empty dates that were supposed to belong to George Strait — and on the ripple effects that are still moving through the city’s music halls, balance sheets, and neighborhoods.

The stages will light up again. The question is how long it will take fans, businesses, and artists to fully feel like the ground under them is steady.

Because as New York just learned, it can take months to build a tour, years to shape a reputation, and only a few short days for one decision to send an entire city’s concert economy into a spin.

News

She Sat in Silence for Years — and Then Dropped a Truth Bomb Live on Air. When This Sports Host Finally Spoke Up, the Studio Froze, the Network Panicked, and the League’s Carefully Guarded Secrets Started to Crack Open.

She Sat in Silence for Years — and Then Dropped a Truth Bomb Live on Air. When This Sports Host…

Rachel Maddow, Stephen Colbert, and Joy Reid Launch Bombshell Independent Newsroom: MSNBC and CBS Stars Ditch Corporate Chains for Raw Truth – Fans Erupt in Cheers as Media Moguls Panic Over ‘Collapse’ Threat

Rachel Maddow, Stephen Colbert, and Joy Reid Launch Bombshell Independent Newsroom: MSNBC and CBS Stars Ditch Corporate Chains for Raw…

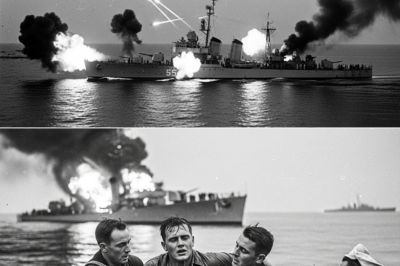

How a Single Downed Airman in a Wide Blue Ocean Led an American Captain to Turn His Ship Toward Enemy Guns, Leaving the Watching Japanese Completely Astonished That Anyone Would Risk So Much for Just One Man

How a Single Downed Airman in a Wide Blue Ocean Led an American Captain to Turn His Ship Toward Enemy…

“The Top-Secret Sea-Hunting Rocket That ‘Saw’ in the Dark: How a Small Team of U.S. Engineers Built a Guided Weapon That Could Find Enemy Ships Without Radar—and Fought to Prove It Wasn’t Science Fiction.”

“The Top-Secret Sea-Hunting Rocket That ‘Saw’ in the Dark: How a Small Team of U.S. Engineers Built a Guided Weapon…

How Eight Hundred Exhausted U.S. Marines Held a Jungle Ridge All Night Against Three Thousand Determined Attackers, Turning a Narrow Strip of Ground Called Bloody Ridge Into the Line That Saved an Entire Island

How Eight Hundred Exhausted U.S. Marines Held a Jungle Ridge All Night Against Three Thousand Determined Attackers, Turning a Narrow…

“The Island ‘Junkyard Scientist’ Who Turned Broken Engines, Rusted Pipes, and Discarded Scrap into a Makeshift Torpedo That Shocked His Own Navy and Stopped a Dangerous Enemy Ship in Its Tracks.”

“The Island ‘Junkyard Scientist’ Who Turned Broken Engines, Rusted Pipes, and Discarded Scrap into a Makeshift Torpedo That Shocked His…

End of content

No more pages to load