At My 33rd Birthday Dinner, My Billionaire Grandpa Said, “Show Me How You’ve Used Your Three-Million-Dollar Trust Fund After Twenty-Five Years,” and the Fight That Followed Exposed Every Lie My Family Told About Money and Love

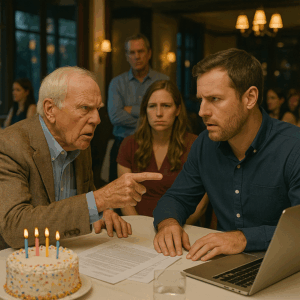

The waiter had just set down my birthday dessert—some over-the-top tower of chocolate, caramel, and a sparkler that made everyone around us clap—when my grandfather tapped his fork against his water glass.

The sound was soft but sharp enough to cut through the noise of the restaurant.

My parents fell quiet.

My older brother Nate put his phone face down for the first time all evening.

Across the long table, my cousin Ava stopped mid-story, her manicured hand frozen in the air.

“Alright,” Grandpa said, rising slowly to his feet. At eighty-two, he still moved like a man who expected rooms to hush for him, and to be fair, they usually did. “I have a toast. And a question.”

Here we go, I thought, plastering on my polite-granddaughter smile. Another story about the “old days” and how he built his company from nothing but a toolbox and stubbornness.

He raised his glass toward me.

“To my granddaughter, Sam,” he said. “Thirty-three years old today. When you were eight, we sat at another table—remember?—with another cake. That was the day I signed papers to create your trust fund.”

A little ripple of interest went around the table. A couple of my cousins perked up like meerkats.

I did remember. The mahogany office, the leather chair that swallowed me whole, the way he’d let me swirl his fountain pen in the air while lawyers explained things I did not understand.

“I promised you three million dollars,” Grandpa continued, his eyes on mine. “I told you it wouldn’t all be yours at once, that it would be invested. I told you you’d have access when you were eighteen, but that the real test would be twenty-five years.”

He lifted his glass a little higher.

“Twenty-five years have passed,” he said. “So, tonight, on your birthday, I want to see it. Show me how you’ve used your three-million-dollar trust fund after twenty-five years.”

The restaurant noise faded into a dull hum in my ears.

Here we go, I thought again—this time in a very different tone.

Across the table, my mother’s fork paused halfway to her mouth. Dad shifted in his chair, straightening his blazer like he wanted to smooth the moment away.

Nate let out a low whistle. “Damn, Grandpa,” he said. “Putting her on the spot much?”

“Language,” Mom snapped automatically, then seemed to remember where we were and who had just spoken.

“Dad,” she said, a flutter of nervous laughter in her voice. “Maybe we talk about finances another time? Let Sam enjoy her birthday.”

“This is enjoying it,” Grandpa said calmly. “I’ve been waiting a quarter of a century for this conversation. I won’t have many more chances.”

The joke landed heavier than he probably meant it to.

He turned his full attention back to me.

“So, Sam,” he said. “You knew this day was coming. Show me what you’ve done.”

Every eye at the table landed on me.

My cheeks burned hot. I took a breath, feeling the familiar swirl of nerves and stubbornness rise in my chest.

Of course he had to do this here. In front of everyone. It was classic Grandpa: turn a private test into a family spectacle.

I’d spent years trying to prepare for this moment, half convinced it would never really happen.

Apparently, tonight, it would.

“Okay,” I said, reaching down for my bag. “You want to see? Let’s see.”

To understand how we got to that very expensive table, you have to go back twenty-five years and a much smaller one.

Back then, I was just a kid who thought three million dollars meant I could buy every stuffed animal at the mall.

My parents and I had driven into the city for my eighth birthday “surprise.” Instead of the zoo or the water park, we ended up in my grandfather’s downtown office.

“Why are we here?” I’d whispered to my mom, staring up at the glass and steel of the building.

She’d smoothed my hair down. “Your grandfather wants to do something important for you,” she’d said. “Be on your best behavior.”

In his office, they sat me in a chair that smelled like leather and old books. A man in a suit slid a folder across the desk.

“This is a trust,” he’d said in a warm, patient voice. “Do you know what that is, Samantha?”

I’d shaken my head, my feet swinging.

“It’s like a treasure chest,” Grandpa had said, leaning forward, his eyes bright. “I’m putting three million dollars in a box with your name on it. You can’t open it yet. But when you’re older, you’ll be able to unlock it. If you’re smart.”

“Three million?” I’d repeated, because even at eight, that number sounded like magic.

“Three million,” he’d confirmed. “Invested. Which means, if it’s handled well, it will grow over time. When you turn eighteen, you’ll be able to access a portion with your parents’ oversight. When you turn twenty-five, the last restrictions lift. But we’re not giving this to you so you can waste it.”

He’d looked at me then with a seriousness that cut through the fog of numbers.

“This is not so you can buy every shiny toy you see,” he’d said. “This is so you can build a life. Or help others build theirs. Money is a tool, Sam. Not a trophy. Do you understand?”

I’d nodded, even though I didn’t.

“Someday,” he’d said, “I’ll ask you what you did with it. And you’ll answer me like an adult.”

Apparently “someday” had an actual date: my thirty-third birthday.

Growing up, the trust fund became a mythical dragon in our house—immense, terrifying, and mostly invisible.

Mom and Dad didn’t come from money. Mom was a school counselor. Dad ran a small landscaping business. We weren’t poor, but we were “one medical bill away from panic” for most of my childhood.

Grandpa was the exception. He’d grown up with even less than my parents and had built a construction company from a one-man operation into a regional powerhouse. By the time I was born, he had more money than he knew what to do with.

Or, as he told it, “more money than the next three generations knew how to handle.”

Hence, the trusts.

Every grandchild got one.

Nate, my brother, two years older than me.

Ava and Justin, my cousins.

Me.

We grew up hearing about “the trust” like other kids heard about college.

“Don’t worry,” Mom would say when the car made a weird noise and the mechanic named a price that made Dad swear under his breath. “The kids will be okay. Your father’s trusts will see to that.”

Sometimes that comforted me. Sometimes it felt like pressure.

When Nate turned eighteen, the myth cracked open a little.

There was a family brunch. A visit to the bank. Conversations hushed behind closed doors.

A few weeks later, a brand-new sports car appeared in our driveway.

“Nate!” I’d squealed. “Is that yours?”

He’d grinned, leaning against the sleek, rented-forever metal. “Partial early release from the vault,” he’d said. “Happy birthday to me.”

Dad had been proud, Mom worried, Grandpa unimpressed.

“A car is not an investment,” Grandpa had told him. “It’s a depreciating asset. Learn the difference.”

Nate rolled his eyes. “Relax, Grandpa. It’s just a drop in the bucket.”

He didn’t say how big the drop was.

After that, the trust fund went from mythical dragon to silent elephant.

It was there, shaping choices, but we didn’t talk about it directly.

When I turned eighteen, I sat in another office, signed a stack of papers, and watched numbers appear on a screen.

Available to you now: $150,000.

Remaining in trust: much, much more.

“You can take some for school,” Mom said, her eyes glowing. “We can upgrade your laptop, your dorm, your car—”

“I got a scholarship,” I said. “Tuition’s covered. Room and board, mostly. And my car runs. Mostly.”

Dad raised his eyebrows. “You worked hard for that scholarship,” he said. “Maybe let this help a little?”

I stared at the numbers.

Three million dollars had always sounded like fake money. Seeing even a fraction of it in an account with my name on it made my stomach flip.

“What if I leave it?” I asked slowly. “Let it grow. Isn’t that the point?”

Mom frowned. “Honey, you don’t have to be a martyr about it. Your grandfather set this up so you could use it.”

“I will,” I said. “I just… don’t know for what yet. Besides, I read the paperwork. Every dollar I take out now is a dollar not invested later.”

Dad snorted. “Listen to the Wall Street Journal over here.”

“Seriously, Sam,” Nate said, leaning in from the doorway. “Live a little. You think this will be around forever? Use it before some market crash or legal loophole or government thing eats it.”

“Or before you convince Mom and Dad to ‘borrow’ from mine to cover your next toy,” I shot back.

His grin faltered. “Rude.”

Mom gave me a look. “Your brother is doing fine.”

We both knew that wasn’t entirely true.

Nate had used a big chunk of his early access for that car. Then more for a “can’t-miss” business idea with a friend that had, predictably, missed. There were rumors of a high-end watch he’d later sold at a loss. Credit card bills.

Each time he stumbled, my parents panicked and Grandpa grew more distant.

“Young men and money,” Grandpa muttered once at a barbecue, watching Nate scroll through his phone. “Like giving matches to a toddler near a fireworks store.”

He’d turned to me then, his gaze sharp.

“How about you, Sam?” he asked. “Burning holes in your pockets?”

“No,” I’d said truthfully. “I’m leaving it invested for now.”

He’d studied me for a long moment, then nodded.

“Good,” he said. “We’ll talk in twenty-five years.”

College passed. Then grad school.

I stayed mostly quiet about the trust fund.

On paper, I was a middle-class kid with a partial scholarship and a part-time job at the campus coffee shop. I rented crappy apartments with thin walls. I learned how to make three dinners out of one grocery run.

The trust sat in the background, quietly growing, quietly waiting.

Sometimes I’d log in to the account and stare at the numbers.

You could zero out your loans with two clicks, I’d think. You could buy your own place instead of listening to the neighbor’s TV every night through the wall. You could say yes when friends planned trips instead of doing math in your notes app.

Instead, I worked. I budgeted. I said no a lot.

It wasn’t about martyrdom. It was about… I don’t know. Proving I could stand without leaning on a pile of money I hadn’t earned.

My major was social work. My internship placements were in schools and community centers where kids talked casually about things that had kept me up at night in theory but now had faces.

“Rent went up again,” one mom said during a parent meeting. “I don’t know how we’re going to stay. I’m working two jobs. It’s not enough.”

“I’m tired,” a sixteen-year-old girl told me. “Tired of worrying every time my little brother coughs because if he gets really sick… we can’t afford a doctor.”

It was impossible to sit in those rooms and not feel the weight of the dragon sitting quietly in my online banking, coiled around numbers that could change lives.

At twenty-five, the last restrictions on the trust lifted.

I got a bland letter from the bank: Dear Ms. Carver, in accordance with the terms of Trust #XXXX, full access is now granted. Please see attached for current balance.

The current balance was slightly more than my grandfather had promised, thanks to years of investment growth.

3,000,000 was now closer to 3,800,000.

I closed the laptop slowly.

“You okay?” Tasha asked from the couch. We’d been roommates since our early twenties, our friendship forged over cheap wine and shared Target runs.

“Yeah,” I said. “Just… realizing I can buy more than the good brand of cereal now.”

She snorted. “I hope that’s the first thing you do. Very glamorous.”

I stared at the screen again.

“What would you do?” I asked. “If you had… this?”

She didn’t ask what “this” was. She knew the basics. I’d told her about the trust in broad strokes years ago, when things with Eric were starting to get serious and I needed someone to say, “No, you’re not crazy to be anxious about telling a guy you’re secretly kind-of wealthy.”

She thought for a long moment.

“Honestly?” she said. “I’d probably pay off my mom’s house. Set up something for my nieces. Maybe go back to school. And I’d take a nap for like a week.”

“That’s very you,” I said.

She nudged my knee with her foot. “Why? What are you thinking?”

I closed the laptop.

“I’m thinking,” I said slowly, “that if I use this money only to make my life easier, I’m going to feel weird. Forever. But if I use it only on other people, I’m going to burn out and resent it. There has to be a balance. I just… don’t know what it looks like yet.”

She nodded. “Then don’t rush,” she said. “The money’s not going anywhere, right? You can make a plan. Not everything has to be some grand gesture.”

It was good advice.

I followed most of it.

The first thing I did with the trust fund was selfish, practical, and entirely necessary.

I bought a small, two-bedroom condo.

Nothing fancy, not in our city. It had beige walls, an older kitchen, a view of a parking lot. But it was mine. Or technically, the trust’s, structured in a way my financial advisor promised was “tax efficient.”

No more thin walls. No more wondering if the landlord would raise the rent. No more moving every year because “the building is being converted” or “my nephew needs the unit.”

My parents were thrilled.

“Finally,” Mom said, hugging me in the empty living room. “Some stability.”

“You used the money,” Dad said, giving Grandpa a pointed look. “See? Responsible decision. You can stop worrying she’s going to put it in a mattress and become a hermit.”

Grandpa had just smiled faintly. “Buying a roof is wiser than buying a car,” he said. “Good first step.”

Nate had made a face. “Must be nice,” he muttered. “Some of us had to figure things out the hard way.”

Some of us spent our early trust withdrawals on a car and a failing food truck, I thought but did not say.

The second thing I did with the trust fund was less visible.

I set up a “donor-advised fund” with part of it, something my advisor suggested when I told her I wanted to give but didn’t know where to start.

“It’s like a mini foundation,” she explained. “You put a chunk in, it gets invested, and you recommend grants to nonprofits over time. It keeps your giving organized. Plus, it has tax benefits.”

Translation: I could do some good and not feel like I was just throwing checks into the void.

I put in a million.

My parents freaked out when I told them.

“A million dollars?” Dad had sputtered. “That’s… Sam, that’s a third of your whole trust!”

“It’s still invested,” I said. “I can’t take it back for myself, but it’s not like I lit it on fire. It’ll grow. And I’ll use it to fund things that actually matter.”

“What about your future children?” Mom asked, eyes wide. “Your retirement? Emergencies?”

“I still have more than enough,” I said. “And I still have my job. This isn’t all I’ll ever have.”

Nate had rolled his eyes again. It was becoming a habit. “You’re too generous,” he said. “One day you’re going to wake up and realize nobody else would do the same for you.”

“Maybe,” I said. “Or maybe I’ll just wake up and be okay with my choices.”

He snorted. “We’ll see.”

Grandpa had been quiet when I told him.

We sat on his back porch, the city skyline a jagged line in the distance.

“You gave away a million,” he said.

“I redirected a million,” I corrected. “To a structure that’s still invested. For other people.”

He sipped his iced tea.

“What for?” he asked.

“Scholarships,” I said. “For students at the high school where I work. A fund for the community clinic so they can hire another therapist. Micro-grants for single parents starting small businesses. I have a whole plan. I can show you.”

I did show him. Spreadsheets. Proposals. A list of organizations I’d researched, people I’d met.

He’d leafed through it, his expression unreadable.

“Don’t give to anyone who calls your phone,” he said finally. “Make them show you what they’ve done. Track it. Don’t just throw money at problems because it makes you feel good.”

“I’m not trying to feel good,” I said. “I’m trying to be useful.”

“That’s better,” he said. “Feeling good is a bonus. Being useful is the point.”

It was the closest thing to approval I’d ever heard from him.

Over the next eight years, my trust fund became less like a dragon and more like a toolbox.

I didn’t talk about it much.

I still worked full-time as a school social worker. Still woke up at 6:00 a.m., still sat in traffic, still dealt with paperwork and cranky parents and fire drills that always seemed to happen on the worst possible days.

My salary covered my regular life.

The trust covered big, chosen things.

When my car finally died for good, I bought another—used, reliable, no sports package.

When the condo building needed a new roof and the HOA fees spiked, I didn’t panic.

When my mom slipped on some ice and broke her wrist, I paid the part of the medical bill insurance didn’t cover without making a big show of it.

Mostly, though, I used the money outward.

We started a scholarship for “quiet kids”—students who weren’t valedictorians or star athletes but showed up, worked hard, and needed a break. It covered tuition at the local community college and a small stipend for books and living expenses.

The first time we awarded it, the recipient’s mom hugged me so hard I couldn’t breathe.

“Whoever did this,” she said, tears streaming down her cheeks, “please tell them they changed our lives.”

I didn’t tell her that “whoever” was me and a pile of money my grandfather had parked in my name.

It didn’t feel important.

We helped the clinic expand their counseling hours. They sent quarterly reports: number of clients seen, waitlist reduced, outcomes tracked. I read every word.

We funded a program that turned a vacant lot into a community garden.

We helped three single parents start tiny businesses: a cleaning service, a home bakery, a mobile barber shop. They repaid some of it as loans, some as “when you’re able” donations back into the fund.

Not everything worked perfectly.

One program fizzled out when the director burned out. One person took the money and ghosted. One nonprofit drowned in its own bureaucracy.

But enough worked that, when I logged into the donor fund dashboard and saw the impact metrics, I felt… steady.

Like the money was finally doing something besides sitting.

The main trust, meanwhile, still grew.

Even after buying the condo and seeding the giving fund, smart investments and a decade of market growth had brought it back up and then some.

The dragon was still there. Just less scary.

My family, however, hadn’t changed as much.

Nate cycled through jobs and girlfriends. He talked a lot about “the next big thing” and how he was “this close” to making it, if only some investor would “believe in him.”

I suspected that “investor” was supposed to be Grandpa. Or me.

My parents hovered between proud and anxious.

“You know your brother’s not as… stable as you,” Mom would say. “He has your father’s temperament.”

“Hey,” Dad would protest half-heartedly.

“He just needs a little help sometimes,” she’d say. “Family helps family.”

I did help. Sometimes. Within limits.

I paid for a couple of Nate’s therapy sessions after he had a scare with stress-related chest pain. I covered a small portion of his credit card debt when the interest threatened to swallow him.

I did not fund his “revolutionary” app idea.

I did not cosign on another car.

I did not let my money become his parachute.

“You’re cold,” he told me once after I refused to front him ten thousand dollars. “You sit on this pile of cash and watch your own brother struggle.”

“I’m not sitting on it,” I said, trying to keep my voice calm. “I’m using it. Just not for that.”

“On strangers,” he sneered. “On people who wouldn’t pee on you if you were on fire.”

“That’s a gross phrase,” I said. “And untrue.”

He’d stormed out.

Mom called later to say, “You know how he gets. You could have thrown him a bone.”

“I’ve thrown him entire cows,” I’d replied. “He needs to learn to stand.”

She’d sighed. “You sound like your grandfather.”

I wasn’t sure if she meant it as a compliment.

Grandpa watched all this from a slight distance.

He still asked about my work, our projects, the kids.

“Don’t get too attached to your ideas,” he’d say. “Sometimes the best thing you can do is pull the plug and move on.”

He never, not once, asked for a detailed report on the trust.

Until my thirty-third birthday.

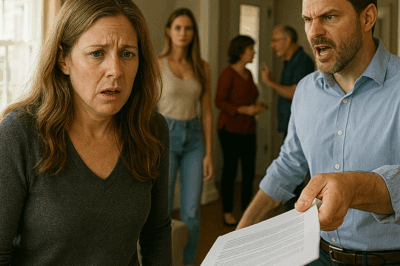

Back at the restaurant, everyone was still staring at me, waiting for my answer.

“Sam?” Mom said, her smile brittle. “Sweetheart, you don’t have to—”

“It’s okay,” I said, standing up slowly. My knees felt weird, like they weren’t entirely convinced this was a good idea. “He’s right. We all knew this day was coming.”

“You did?” Ava whispered to Justin.

“Grandpa gave us the ‘someday I’ll ask’ speech,” he murmured back. “I thought he forgot. Or died first.”

Grandpa’s mouth twitched at that.

“I brought something,” I said, pulling my laptop out of my bag. “Just in case.”

Dad groaned softly. “You made a presentation?”

“What, you wanted me to bring a treasure chest?” I asked.

A couple of cousins snickered.

The waiter, sensing either drama or a big tip or both, topped off water glasses and retreated.

I opened the laptop, heart thudding, and connected to the restaurant’s big TV screen via the cable I’d also brought “just in case.”

The screen blinked to life.

On it, a simple title slide: Trust Fund Report – 25 Years Later.

Nate made a choking noise. “You’ve got to be kidding me.”

“I work in schools,” I said. “It’s either a PowerPoint or a trifold poster. Be grateful.”

Someone at a nearby table glanced over, intrigued. I ignored them.

I clicked to the next slide.

“Okay,” I said, slipping into my work voice, the one I used for parent nights. “Here’s the basic overview.”

A chart appeared, clean and simple.

“Grandpa created the trust twenty-five years ago with an initial funding of three million dollars,” I said. “It was invested conservatively—thanks for that, by the way.”

Grandpa raised his glass slightly in acknowledgment.

“Over time, with market growth and reinvested returns, it grew to about 3.8 million by the time the last restrictions lifted when I turned twenty-five. Since then, its balance has fluctuated with the market, plus or minus, but overall, it’s grown, even with distributions.”

“Distributions,” Nate muttered. “Fancy word for ‘spending spree.’”

“Except it wasn’t,” I said. “Here’s where things went.”

I clicked.

Three pie charts appeared: Personal Assets, Giving / Community Investment, Remaining Principal & Growth.

“In the past eight years,” I said, “I’ve used the trust for three main categories.”

I pointed to the first section.

“Personal: I bought my condo. I’ve handled some medical costs for myself and Mom when insurance fell short. I replaced my car when it died. Total personal spending from the trust: about $650,000 over eight years, most of that the condo and renovations.”

Mom’s eyes widened. “That much?”

“Market here is no joke,” I said. “You’ve seen the prices. But I bought something modest. I still have a mortgage. I did not buy a mansion.”

I pointed to the second section.

“Giving and community investment: I seeded a donor-advised fund with one million. It’s now worth about 1.2 million, thanks to growth. From that, we’ve given out around $400,000 in grants over the past eight years. Not all at once. In specific, tracked amounts.”

“Tracked?” Grandpa repeated.

I clicked again.

The slide filled with bullet points.

“Twenty-eight full scholarships to community college,” I said, my voice steadier now that I was in data mode. “Forty-three partial ones. Two hundred and twelve students received smaller emergency grants for books, transportation, or application fees.”

A murmur went around the table.

“The community clinic hired two additional part-time therapists with our funding,” I continued. “They’ve served approximately nine hundred extra clients over three years, most of them uninsured or underinsured.”

I flipped to the next slide, which showed before-and-after photos.

“We converted a vacant lot into a community garden. Part of the fund paid for raised beds, tools, and a part-time coordinator. The rest was volunteer labor. It now supplies fresh produce to about forty families in the neighborhood and runs a kids’ summer program.”

I saw Ava’s eyes go soft at the picture of kids in oversized gardening gloves holding up carrots like trophies.

“We also provided micro-grants to three local entrepreneurs,” I said. “One cleaning business, one bakery, one barber shop. Two are profitable and repaying; one closed, but the owner landed a better job using the skills she developed. Not every bet was a win, but overall, the fund’s impact has been positive and measurable.”

I clicked to a slide that showed the overall fund growth.

“Even with that giving,” I said, “the main trust plus the donor fund combined are currently worth about 4.1 million. The original three million Grandpa put in has grown past that, even with my spending.”

I looked up.

“Meaning,” I said, “I have used a significant amount of the trust, yes. But I have not blown it. And the principal? It’s intact and then some.”

For a moment, there was only the clink of glass on glass at another table.

Then Nate laughed. A short, disbelieving sound.

“You gave away four hundred thousand dollars?” he said. “On… carrots and broke college kids?”

“Not gave away,” I said. “Invested in. That’s the point.”

He shook his head. “You could’ve paid off Mom and Dad’s house. You could’ve set me up in a real business. You could’ve—”

“Could’ve,” I said. “But I didn’t. That money was entrusted to me. Not to you. Not to Mom and Dad. To me. Grandpa gave each of us our own. What I did with mine is my responsibility.”

Mom swallowed. “We never asked you to pay off the house.”

“Not directly,” I said. “But you talked about it. You dropped hints. You said, ‘It sure would be nice if we didn’t have to worry about the mortgage in retirement.’ I heard you. I love you. I also know that if I started paying all your bills, it wouldn’t stop at the house.”

Her eyes filled. “You think so little of us?”

“No,” I said softly. “I think you’re human. And I think money can twist things. I’ve seen it. I see it in our family. Every holiday, someone’s mad about who got what, who paid for what, who owes who.”

“That’s not true,” Dad said weakly.

Ava snorted. “Come on, Uncle Mark. We all see it. Every time Grandpa picks up the check, half the table starts calculating what they’re ‘owed.’”

“Thank you,” Justin said dryly. “For saying the quiet part out loud.”

The air shifted again.

và cuộc tranh cãi trở nên nghiêm trọng—and the argument became serious.

Grandpa was still standing, his hand loose around his glass, his gaze steady.

“What about you?” he asked quietly. “Outside of the numbers. Where are you in all this?”

I blinked. “What do you mean?”

“You’ve used the trust to house yourself and help others,” he said. “Good. But what about your life? Are you happy? Do you feel like you’ve used it in a way that matches who you are?”

I thought of early mornings at the school, of kids dropping into my office to vent. Of late nights writing grant proposals for nonprofits that couldn’t afford a staff writer. Of tears and exhaustion and those weird, shining moments when someone said, “You helped.”

“I think so,” I said slowly. “I didn’t want the trust to become a golden cage. I didn’t want to live off it and drift. I wanted it to be… support. Security. And leverage. I like my work. I like my life. I don’t regret not buying a yacht.”

“You could’ve at least got a nicer car,” Nate muttered.

Grandpa’s mouth quirked. “You hate driving, Sam.”

“I do,” I agreed. “So why would I buy something I hate being in?”

“Fair,” he said.

Dad cleared his throat. “So… let me get this straight. You’ve been quietly playing charity with a big chunk of that money, and not telling us?”

“Yes,” I said. “I told you about some of it. You thought it was ‘nice.’ You didn’t ask for details. I didn’t think you were interested.”

“And what about us?” he asked, gesturing between himself and Mom. “We worked our whole lives. Scraped and saved. We thought the trusts meant our kids would have it easier. We didn’t think we’d have to worry about… where we fit in that picture.”

“You fit like you always have,” I said. “As my parents, not my dependents. I will help you if you truly need it. I already have. But I’m not your retirement plan. That was never the deal.”

Mom flinched.

“Your grandfather promised ‘the kids will be taken care of,’” she said. “We heard that as ‘the family will be taken care of.’ Maybe we misunderstood. But can you blame us?”

“No,” I said. “I can’t. But I also can’t live my life based on a version of a promise that was never actually made.”

Nate shook his head, anger rising.

“Easy for you to say,” he snapped. “You’ve always been the favorite. Grandpa gives you a trust, you get your little charity projects, you get the halo. Meanwhile, the rest of us are out here trying to survive.”

“You all got trusts,” I said. “Identical ones. What you did with them is on you.”

“That’s not fair,” he said. “My “identical” trust had to cover my business. My mistakes. You didn’t have those.”

“Those weren’t acts of God,” I said, my own temper finally sparking. “You chose to buy a car you couldn’t maintain. You chose to sink money into a poorly researched food truck. You chose not to listen when Grandpa told you to get a financial advisor. Those were choices, not fate.”

He stood up so fast his chair squeaked.

“You think you’re so much better than me,” he said, his voice low and tight. “Saint Samantha, who gives money to strangers and thinks that makes her wise.”

“I don’t think I’m better than you,” I said. “I think I made different choices with the same resources. That’s all.”

“That’s not all,” he said. “You had Grandpa’s attention. His lectures. His stupid little tests. He never bothered with me the same way.”

“That’s not true,” Grandpa said quietly. “I tried. You didn’t want to hear it.”

Nate snorted. “Yeah? Then why does she get this little performance review and I get the silent treatment?”

“Because she asked for my advice,” Grandpa said. “You asked for my money.”

The table went very still.

“Okay,” Mom said, her voice shaking. “We’re not doing this. Not on a birthday. Not with dessert on the table. Dad, this was unfair. Putting her on the spot like this. We all have our own paths. We don’t need to compare ledgers.”

“This was never about comparing ledgers,” Grandpa said. “It was about character. But since everyone’s so worried about fairness…”

He reached into his jacket pocket and pulled out a folded envelope.

My stomach dropped.

I knew that envelope. The old, heavy-printer-paper kind his lawyer used.

“This was meant for another time,” he said. “But I think now is as good as any.”

“Dad,” Mom said warningly. “Please.”

He opened the envelope and slid out a few pages.

“This is my updated estate plan,” he said, and someone down the table made a strangled noise.

“Oh my God,” Ava whispered to Justin. “Is he seriously doing the will talk at dinner?”

“Of course he is,” Justin muttered back. “He lives for this.”

Grandpa ignored them.

“I’m not going to read you the whole thing,” he said. “But I will say this: I split the original trusts equally because I wanted to see what each of you did with what you were given. A lab experiment, if you like. Not entirely fair, perhaps, but life rarely is.”

He looked directly at me.

“Some of you treated the trusts like lottery winnings,” he said. “Some treated them like lifelines. Sam treated hers like a tool with a purpose beyond herself. That matters to me.”

Nate’s face went red. “So what, she gets everything?”

“No,” Grandpa said. “This is not a fairy tale. But I have named her executor of the charitable foundation that will receive a large portion of my estate. She’ll oversee how it’s used. Not to punish the rest of you, but because she’s shown me she can think beyond her own nose.”

“You made her in charge?” Mom said, hurt and something like panic in her voice. “Of everything?”

“Of one part,” he said. “The giving part. The rest is divided. Some of you will probably be disappointed. That’s inevitable. But if you’re angry, be angry at me, not at her.”

Eyes turned to me again, this time sharper. Some resentful. Some calculating.

I felt suddenly very exposed. Not like a hero. Like a target.

“I didn’t ask for that,” I said, my voice small in my own ears.

“I know,” Grandpa said. “That’s partially why you’re getting it.”

“That doesn’t make it easier,” I said.

“No,” he agreed. “It won’t be. Being responsible rarely is.”

Dad put his head in his hands for a moment, then looked up.

“Dad,” he said. “This is too much. You’re setting her up to be the bad guy for the rest of her life.”

“Or the good guy,” Grandpa said. “Depends on how the rest of you behave.”

Justin let out a surprised laugh.

“No offense,” he said, “but I don’t want Sam to be my personal hero or villain. I just want us all to stop acting like the only measure of love is who gets what check.”

“Then act like it,” Grandpa said.

“Easy for you to say,” Ava muttered. “You’re the one writing the checks.”

“Which is why I get to decide where they go,” he said. “You’re all adults. You can make your own money. Or not. But you won’t be able to say nobody ever gave you a chance.”

Silence fell again.

My chocolate tower of dessert had melted into a sad puddle.

I took a breath.

“Okay,” I said. “Can I say something?”

“No,” Nate snapped. “You’ve said enough.”

“Yes,” Grandpa said at the exact same time.

I waited a beat, then spoke.

“I appreciate the trust,” I said. “Both the financial one from twenty-five years ago and this new one. But I need to make something clear: I am not going to be the family’s complaint department about money. If you’re mad about how Grandpa split things, take it up with him while he’s here. Don’t wait until he’s gone and then turn it on me.”

“That’s easy for you to say,” Nate started.

“No,” I said, louder than I meant to. “It’s not. None of this is easy. I know how it looks. ‘Sam gave away money and got rewarded with more money.’ That’s a gross story if you frame it that way. It’s not one I asked for. But here we are.”

I looked around the table.

“At the end of the day,” I said, “we’re still family. The trust funds, the wills, the numbers—those are all background noise. Loud background noise, sure, but still background. What matters is how we treat each other. I can’t control Grandpa’s decisions. I can only control what I do with what’s given to me. And I’m telling you right now: I’m going to use it the same way I’ve been using it. Carefully. With intention. Beyond just myself.”

I let out a breath I didn’t realize I’d been holding.

“If that makes you angry,” I said, “I can’t fix that for you. But I’m not going to apologize for trying to do something decent with an absurd amount of money I happened to be born into.”

The words hung there.

Tasha, who’d been quiet at the far end (Grandpa had insisted she come; “Anyone who’s put up with you this long deserves a good meal”), raised her glass.

“Well,” she said lightly, “I, for one, think your absurd amount of money has been used pretty well. And no, I’m not just saying that because you pay for my snacks sometimes.”

A few people chuckled. The tension loosened, just a hair.

Grandpa smiled, a rare, genuine smile.

“That’s what I wanted to see,” he said. “Not the slides. Not the pie charts. You.”

He sat down slowly.

“Happy birthday, kid,” he said. “You did alright.”

Later, after awkward goodbyes and a round of separate checks (“Yes, we’re sure,” Grandpa told the confused waiter. “They can all pay for their own dinner.”), he pulled me aside outside the restaurant.

The night air was cool. The city lights blinked like tired eyes.

“You know they’re going to talk,” he said.

“I figured,” I said. “Some of them already do.”

“You didn’t have to show them that much,” he said. “You could’ve just given me the highlights.”

“I know,” I said. “But then the rumors would’ve been worse. I’d rather they be mad about the truth than about their own stories.”

He nodded slowly.

“Your grandmother would’ve liked you,” he said. “She hated waste.”

“I remember her coupon binder,” I said, smiling. “I think about it every time I negotiate with a contractor.”

He chuckled.

“You’re going to have options, Sam,” he said. “More than I ever did. More than your parents. That’ll attract some people. Repel others. Just remember: the money is not who you are. It’s just… loud. Be louder.”

“Louder than a few million dollars?” I said. “That’s a big ask.”

“You’ve already started,” he said. “Keep going.”

We stood there for a moment, watching cars glide past.

“Why me?” I asked finally. “Why the executor thing? Why not split it between us? Or give it to professionals?”

“Professionals don’t care about kids from your school,” he said. “Or that garden. Or that clinic. They care about percentages and endowments. You care about faces. I trust that more.”

“That’s a lot of pressure,” I said.

He shrugged. “You handle pressure well. You didn’t crumble tonight.”

“I almost threw up on my laptop,” I said.

“Almost,” he replied. “But you didn’t. That’s the difference.”

He patted my shoulder, then winced.

“Damn shoulder,” he muttered. “Getting old is a scam.”

I laughed.

“Go home,” he said. “Eat some real cake. Take tomorrow off work if you can. Thirty-three should come with a personal day.”

“I already put in for it,” I said. “Plan to sleep in.”

“Good,” he said. “You’ve earned it.”

That night, back in my condo, I sat on my couch with a slice of leftover birthday cake and my laptop.

An email notification pinged.

It was from one of our scholarship recipients, now a junior at the state university.

Ms. Carver, it read.

I just wanted to say thank you again. I know you always tell us “focus on your classes, not on me,” but I wouldn’t be here without the support you helped set up. I got into the nursing program. My little sister keeps my acceptance letter on the fridge. My mom cries every time she looks at it, but in a good way. I’m going to make you proud. Just wanted you to know.

My throat tightened.

I thought about the argument at the restaurant. The pie charts. The hurt looks.

I thought about Nate’s anger, my parents’ fear, my cousins’ wary curiosity.

I thought about Grandpa’s voice: The money is not who you are. It’s just loud. Be louder.

I hit reply.

You already make me proud, I wrote.

Keep going. And when you’re in a position to help someone else someday, do it. That’s the only “thank you” I want.

I hit send.

Then I closed the laptop, turned off the TV, and sat in the quiet hum of my ridiculous, complicated life.

A life where a man who’d once signed a piece of paper for three million dollars had just asked me, in front of everyone, to justify it.

A life where my answer wasn’t perfect, but it was mine.

I didn’t know what the next twenty-five years would look like. There would be more arguments, more tests, more people who saw me as a walking wallet instead of a person.

But there would also be more kids with acceptance letters on fridges. More gardens. More small businesses. More people who got a little bit of breathing room because a girl with a trust fund decided to treat it like a tool.

At my birthday table, the argument had become serious.

In my living room, it became something else.

A promise.

Not to my grandfather. Not to my family.

To myself.

To keep using what I’d been given in a way that, if I had to, I could stand up in any room—birthday, boardroom, or courtroom—and say, honestly:

Here is what I did.

Here is who it helped.

Here is who I am, with or without the money.

THE END

News

The Night Before My Birthday My Late Father Warned Me In A Dream Not To Wear The Dress, I Ignored Him Until A Furious Family Argument Finally Exposed The Secret Of His Death And Why He Needed Me To Say No

The Night Before My Birthday My Late Father Warned Me In A Dream Not To Wear The Dress, I Ignored…

In the Middle of My Big Presentation, My Manager Slammed the Table, Called It a Disaster, and Accidentally Started the Showdown That Finally Exposed Our Toxic Office and Changed My Career Forever

In the Middle of My Big Presentation, My Manager Slammed the Table, Called It a Disaster, and Accidentally Started the…

My Family Skipped My College Graduation for My Sister’s ‘Important’ Dance Recital, but the Photos I Saw Later, the Explosive Fight at Dinner, and the Truth About Years of Favoritism Changed Everything Between Us

My Family Skipped My College Graduation for My Sister’s ‘Important’ Dance Recital, but the Photos I Saw Later, the Explosive…

THE CHRISTMAS EVE THAT CHANGED EVERYTHING

When My Entitled Sister Demanded I Babysit Her Five Kids on Christmas Eve or Be Banned From Family Dinner, She…

My Husband Hurled Divorce Papers At Me, Gave Me Thirty-Six Hours To Move Out For His New Girlfriend, And Accidentally Triggered The Fight That Finally Freed Me And Cost Him Everything He Took For Granted

My Husband Hurled Divorce Papers At Me, Gave Me Thirty-Six Hours To Move Out For His New Girlfriend, And Accidentally…

After My Husband Lashed Out at Me, I Went to Bed Without a Word, and the Next Morning He Woke Up to the Smell of His Comfortable Life Ending as I Finally Chose Myself Over His Temper

After My Husband Lashed Out at Me, I Went to Bed Without a Word, and the Next Morning He Woke…

End of content

No more pages to load